Along the way, Zuckerberg was given many opportunities to exit. He was offered $75 million from Viacom in the very early days, and then $1.5 billion later on (including $800 million cash up front). Yahoo also missed out on making a deal after having its $1 billion offer rejected in 2006. Zucks kept to his guns, even despite significant pressure to sell. As Peter Thiel recounts, Zuckerberg didn’t know what he’d do with the money, and would likely just start another social networking site anyways. Given his vision for Facebook and an obvious passion for connecting people, it’s not surprising to learn that over the next 10 years, Zuckerberg plans to execute just as ambitiously.

Facebook’s Masterplan

Today’s infographic comes from Futurism, and it details Facebook’s masterplan to potentially make the company a $1 trillion colossus. It’s worth noting that Facebook is technically already about one year into the 10-year plan, and that the infographic has been updated to include the latest developments in the company as of 2017. Here are the ambitious plans that the company hopes to bring to a reality:

Use solar-powered drones to beam internet access to Earth. Build hardware that will boost internet connectivity in dense urban areas. Launch a satellite to help provide internet access to Africa. Enable artificial intelligence to learn about content. (ie. what a video or image is all about.) Train neural networks through Facebook’s open source Torch system. Build VR/AR headsets that look like a normal pair of glasses. Work on new social experiences using virtual reality as a social platform. Continued development of the Brain-Computer interface project to allow users to “type” with their thoughts.

The latter of these plans was just announced just last week, and it involves a team of 60 engineers working to find a way to translate your thoughts into Facebook updates. Using non-invasive optical imaging to scan your brain a hundred times per second, eventually the goal is to allow people to “type” at 100 words per minute, a 5x increase over normal phone typing speeds. on The good news is that the Federal Reserve, U.S. Treasury, and Federal Deposit Insurance Corporation are taking action to restore confidence and take the appropriate measures to help provide stability in the market. With this in mind, the above infographic from New York Life Investments looks at the factors that impact bonds, how different types of bonds have historically performed across market environments, and the current bond market volatility in a broader context.

Bond Market Returns

Bonds had a historic year in 2022, posting one of the worst returns ever recorded. As interest rates rose at the fastest pace in 40 years, it pushed bond prices lower due to their inverse relationship. In a rare year, bonds dropped 13%.

Source: FactSet, 01/02/2023.

Bond prices are only one part of a bond’s total return—the other looks at the income a bond provides. As interest rates have increased in the last year, it has driven higher bond yields in 2023.

Source: YCharts, 3/20/2023.

With this recent performance in mind, let’s look at some other key factors that impact the bond market.

Factors Impacting Bond Markets

Interest rates play a central role in bond market dynamics. This is because they affect a bond’s price. When rates are rising, existing bonds with lower rates are less valuable and prices decline. When rates are dropping, existing bonds with higher rates are more valuable and their prices rise. In March, the Federal Reserve raised rates 25 basis points to fall within the 4.75%-5.00% range, a level not seen since September 2007. Here are projections for where the federal funds rate is headed in 2023:

Federal Reserve Projection*: 5.1% Economist Projections**: 5.3%

*Based on median estimates in the March summary of quarterly economic projections.**Projections based on March 10-15 Bloomberg economist survey. Together, interest rates and the macroenvironment can have a positive or negative effect on bonds.

Positive

Here are three variables that may affect bond prices in a positive direction:

Lower Inflation: Reduces likelihood of interest rate hikes. Lower Interest Rates: When rates are falling, bond prices are typically higher. Recession: Can prompt a cut in interest rates, boosting bond prices.

Negative

On the other hand, here are variables that may negatively impact bond prices:

Higher Inflation: Can increase the likelihood of the Federal Reserve to raise interest rates. Rising Interest Rates: Interest rate hikes lead bond prices to fall. Weaker Fundamentals: When a bond’s credit risk gets worse, its price can drop. Credit risk indicates the chance of a default, the risk of a bond issuer not making interest payments within a given time period.

Bonds have been impacted by these negative factors since inflation started rising in March 2021.

Fixed Income Opportunities

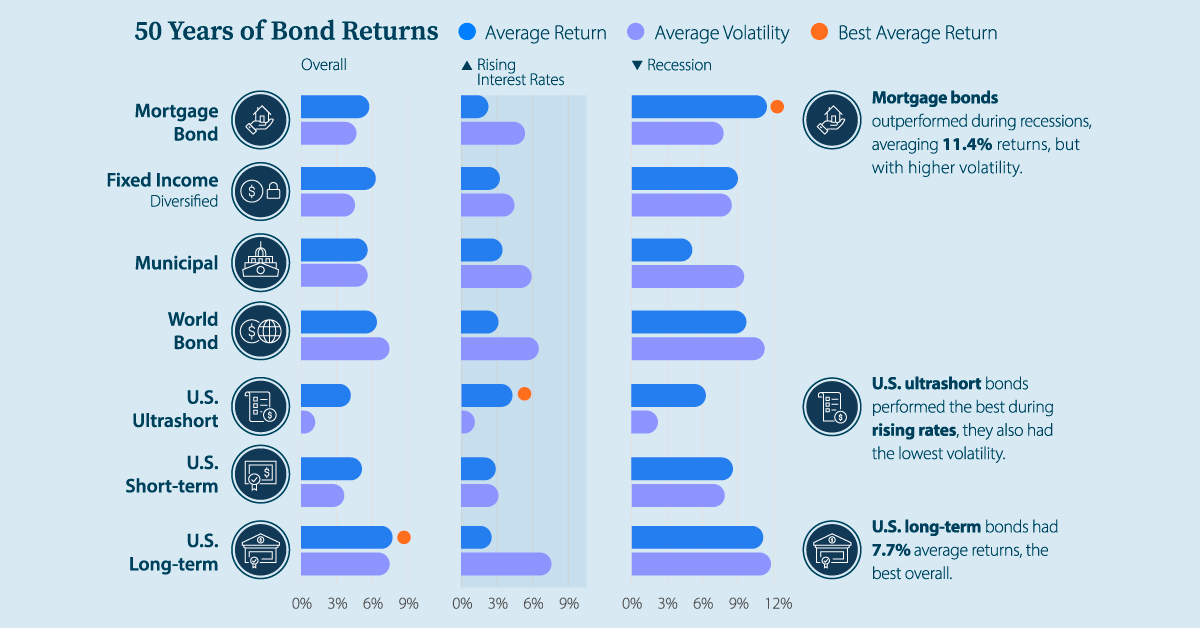

Below, we show the types of bonds that have had the best performance during rising rates and recessions.

Source: Derek Horstmeyer, George Mason University 12/3/2022. As we can see, U.S. ultrashort bonds performed the best during rising rates. Mortgage bonds outperformed during recessions, averaging 11.4% returns, but with higher volatility. U.S. long-term bonds had 7.7% average returns, the best across all market conditions. In fact, they were also a close second during recessions. When rates are rising, ultrashort bonds allow investors to capture higher rates when they mature, often with lower historical volatility.

A Closer Look at Bond Market Volatility

While bond market volatility has jumped this year, current dislocations may provide investment opportunities. Bond dislocations allow investors to buy at lower prices, factoring in that the fundamental quality of the bond remains strong. With this in mind, here are two areas of the bond market that may provide opportunities for investors:

Investment-Grade Corporate Bonds: Higher credit quality makes them potentially less vulnerable to increasing interest rates. Intermediate Bonds (2-10 Years): Allow investors to lock in higher rates.

Both types of bonds focus on quality and capturing higher yields when faced with challenging market conditions.

Finding the Upside

Much of the volatility seen in the banking sector was due to banks buying bonds during the pandemic—or even earlier—at a time when interest rates were historically low. Since then, rates have climbed considerably. Should rates moderate or stop increasing, this may present better market conditions for bonds. In this way, today’s steep discount in bond markets may present an attractive opportunity for price appreciation. At the same time, investors can potentially lock in strong yields as inflation may subside in the coming years ahead. Learn more about bond investing strategies with New York Life Investments.