According to Zenith Global, the U.S. CBD-infused drinks market will reach an estimated $1.4 billion by 2023, making it one of the fastest-growing segments in the overall industry. Today’s infographic comes to us from Trait Biosciences, and outlines the magnitude of the CBD-infused beverage segment, along with some of the subsequent challenges and opportunities that will shape the future of cannabis.

CBD and its Benefits

CBD is an abbreviated term for cannabidiol, a type of cannabinoid that makes up 40% of a cannabis plant’s extract. It has become increasingly popular for relieving pain, promoting relaxation, and lifting mood without the psychoactive properties that come with THC (Tetrahydrocannabinol), the other major cannabinoid. Recent studies suggest that CBD’s properties may be useful in combating a variety of health conditions such as epilepsy, schizophrenia, multiple sclerosis, migraines, arthritis, and even side effects of cancer.

The New Wave of Beverages

CBD-infused beverages will open the floodgates to new audiences who want to consume cannabis in different formats. They have many benefits, that will rival other methods of ingestion:

Easy to Administer Beverages are seen as the healthier way to consume CBD, especially compared to smoking. More Accessible They are becoming more easily available in restaurants, bars, supermarkets, and online sites. Functionality There is some evidence to suggest that CBD in caffeinated products can curtail the feeling of being on “edge”. Higher Precision Dosage is controlled and, much like alcohol, consumers will be able to determine how much CBD content they want. Both alcoholic and non-alcoholic product categories are currently being explored, resulting in some unexpected partnerships, such as Molson Coors—the world’s seventh largest brewer—and Hexo Corp, a Canadian cannabis product company. Trends Shaping the Future of CBD Beverages The CBD product landscape is constantly evolving. Demand for CBD-infused beverages will be fueled by three key trends.

As these trends evolve, consumers will benefit from more education around CBD, which could lead to more CBD products, like beverages, entering the mainstream across numerous industries.

Trends Shaping the Future of CBD Beverages

The CBD product landscape is constantly evolving. Demand for CBD-infused beverages will be fueled by three key trends.

What’s Next for the CBD-infused Beverage Market?

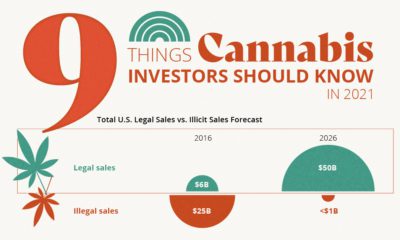

CBD purity is a primary focus area of current scientific studies. For consumers, more transparency is needed around ingredients, dosage levels, and product labeling. For example, the state of Indiana now mandates that manufacturers must label CBD products with QR codes that can be scanned to show whether they contain acceptable levels of THC, CBD, pesticides, and other compounds. Most notably, new methods of CBD infusion will transform the beverages market. Many industry players have used nano-emulsion to infuse CBD. However, these fat-based nanoparticles have been known to accumulate in organs, causing health concerns. That’s why creating water-soluble CBD has been an emerging industry priority. CBD-infused beverages are poised to become the next big thing and create massive economic growth—despite strict industry regulations. Scientific advancements and changing laws will unlock the potential of the CBD market, potentially disrupting the entire beverage industry. on Humans have a storied and complicated relationship with drugs. Defined as chemical substances that cause a change in our physiology or psychology, many drugs are taken medicinally or accepted culturally, like caffeine, nicotine, and alcohol. But many drugs—including medicines and non-medicinal substances taken as drugs—are taken recreationally and can be abused. Each country and people have their own relationship to drugs, with some embracing the use of specific substances while others shun them outright. What are the most common drugs that are considered generally illicit in different parts of the world? Today’s graphics use data from the UN’s World Drug Report 2021 to highlight the most prevalent drug used in each country.

What Types of Common Drugs Are Tracked?

The World Drug Report looks explicitly at the supply and demand of the international illegal drug market, not including commonly legal substances like caffeine and alcohol. Drugs are grouped by class and type, with six main types of drugs found as the most prevalent drugs worldwide.

Cannabis*: Drugs derived from cannabis, including hemp. This category includes marijuana (dried flowers), hashish (resin), and other for various other parts of the plant or derived oils. Cocaine: Drugs derived from the leaves of coca plants. Labeled as either cocaine salts for powder form or crack for cocaine processed with baking soda and water into rock form. Opioids: Includes opiates which are derived directly from the opium poppy plant, including morphine, codeine, and heroin, as well as synthetic alkaloids. Amphetamine-type Stimulants (ATS): Amphetamine and drugs derived from amphetamine, including meth (also known as speed), MDMA, and ecstasy. Sedatives and Tranquilizers: Includes other drugs whose main purpose is to reduce energy, excitement, or anxiety, as well as drugs used primarily to initiate or help with sleep (also called hypnotics). Solvents and Inhalants: Gases or chemicals that can cause intoxication but are not intended to be drugs, including fuels, glues, and other industrial substances.

The report also tracked the prevalence of hallucinogens—psychoactive drugs which strongly affect the mind and cause a “trip”—but no hallucinogens ranked as the most prevalent drug in any one country. *Editor’s note: Recreational cannabis is legal in five countries, and some non-federal jurisdictions (i.e. states). However, in the context of this report, it was included because it is still widely illicit in most countries globally.

The Most Prevalent Drug in Each Country

According to the report, 275 million people used drugs worldwide in 2020. Between the ages of 15–64, around 5.5% of the global population used drugs at least once. Many countries grouped different types of the same drug class together, and a few like Saudi Arabia and North Macedonia had multiple different drug types listed as the most prevalent. But across the board, cannabis was the most commonly prevalent drug used in 107 listed countries and territories: How prevalent is cannabis worldwide? 72 locations or more than two-thirds of those reporting listed cannabis as the most prevalent drug. Unsurprisingly these include countries that have legalized recreational cannabis: Canada, Georgia, Mexico, South Africa, and Uruguay.

How Common Are Opioids and Other Drugs?

Though the global prevalence of cannabis is unsurprising, especially as it becomes legalized and accepted in more countries, other drugs also have strong footholds. Opioids (14 locations) were the most prevalent drugs in the Middle-East, South and Central Asia, including in India and Iran. Notably, Afghanistan is the world’s largest producer of opium, supplying more than 90% of illicit heroin globally. Amphetamine-type drugs (9 locations) were the third-most common drugs overall, mainly in East Asia. Methamphetamine was the reported most prevalent drug in China, South Korea, and Japan, while amphetamine was only the most common drug in Bangladesh. However, it’s important to note that illicit drug usage is tough to track. Asian countries where cannabis is less frequently found (or reported) might understate its usage. At the same time, the opioid epidemic in the U.S. and Canada reflects high opioid usage in the West. As some drugs become more widespread and others face a renewed “war,” the landscape is certain to shift over the next few years.