In a short amount of time, technological innovations such as wireless internet and social networking have become a ubiquitous part of our everyday lives, quietly transforming the way we live, work, and communicate. Other promising technologies have their moment in the sun, only to fade into obscurity. Gartner’s Hype Cycle charts the roller coaster ride of emerging tech, from the first stirrings of public awareness to the point of wider adoption and economic viability. Today’s graphic is a retrospective look at which trends scaled the summit of the Hype Cycle each year since 2000.

Reaching the Peak

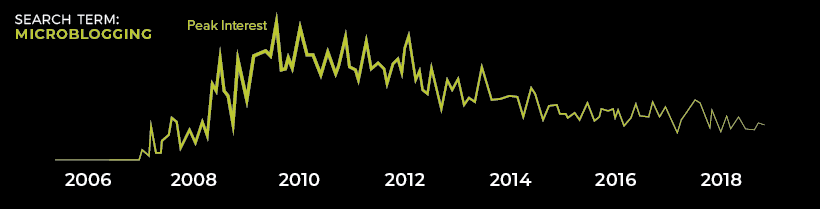

As the media searches for the next big thing, certain technologies tend to dominate the headlines. Meanwhile, venture capital flows into the companies racing to bring the tech to market, valuations swell, marketing departments generate excitement, and the expectations of the general public begin to grow as well. One example of this phenomenon at work is the adoption of microblogging. Today, we don’t think twice about posting a tweet or updating our status on Facebook, but a decade ago, the act of posting a short public message was major shift in the way people used technology to communicate with one another. The intense buzz that sent microblogging towards the top of the Hype Cycle is corroborated by Google Search data.

Living Up to the Hype

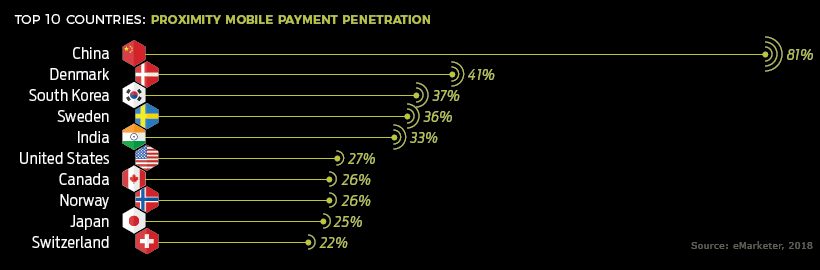

A few technologies transcend the hype to transform entire industries. Here are some examples that lived up to their time in the spotlight. Cloud Computing Right from the beginning, the analogy of data breaking the shackles of folders and clunky external drives – instead zipping efficiently into the invisible cloud – generated a lot of excitement. It felt like the future of computing, and enterprises and individuals eagerly adopted the technology. NFC Payments Near Field Communication – the technology that enables contactless payments – is transforming the way people pay for purchases around the world. The global contactless payments market is expected to reach $138.4 billion by 2023. Here’s a look at where NFC payments are making the greatest in-roads:

The Ones That Underwhelmed

Fast-forward to today, and only 19% of adults in the U.S. own an e-reader. Of course, not every technology that grabs the headlines is going to become the next iPhone. Here are some others that didn’t immediately meet expectations after topping the Hype Cycle. m-Commerce Some concepts fail primarily because they’re ahead of their time. Such is the case with mobile commerce. By 2001, more than half of Americans owned mobile phones, and this represented a huge opportunity. Unfortunately, early m-commerce was restricted by the limitations of mobile phones of that time period. It wasn’t until the introduction of smartphones that the concept really took off. Today, nearly half of all online transactions are made via mobile devices. 3D Printing Few technologies reach the fever pitch that 3D printing did in 2012. From the $1.4 billion merger of the largest players in the sector to the reports of firearm blueprints circulating the web, you could forgive people for believing that the 3D printer was destined to become the next microwave. In the end, interest in 3D printing leveled off. While it is getting used for prototyping in many different industries, it remains to be seen whether the technology will ever achieve the wide consumer-level adoption that was promised.

What’s Next?

When 2019’s Hype Cycle is released later this year, it remains to be seen which technology will rise to the top. Based on the trajectory from last year, search volume, and current news reports, 5G is a strong competitor. on But fast forward to the end of last week, and SVB was shuttered by regulators after a panic-induced bank run. So, how exactly did this happen? We dig in below.

Road to a Bank Run

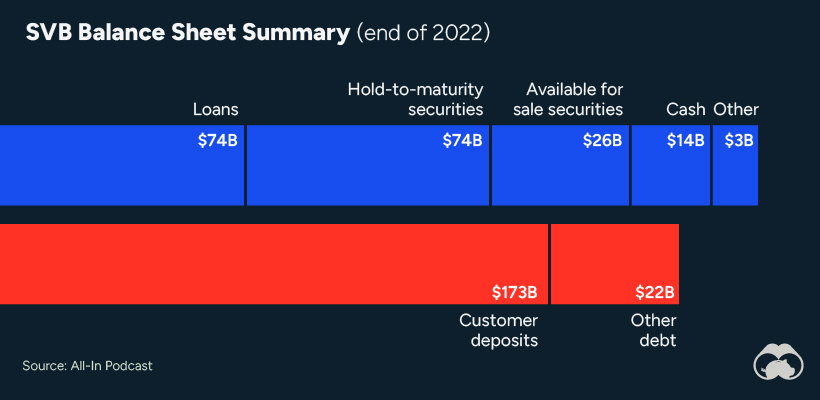

SVB and its customers generally thrived during the low interest rate era, but as rates rose, SVB found itself more exposed to risk than a typical bank. Even so, at the end of 2022, the bank’s balance sheet showed no cause for alarm.

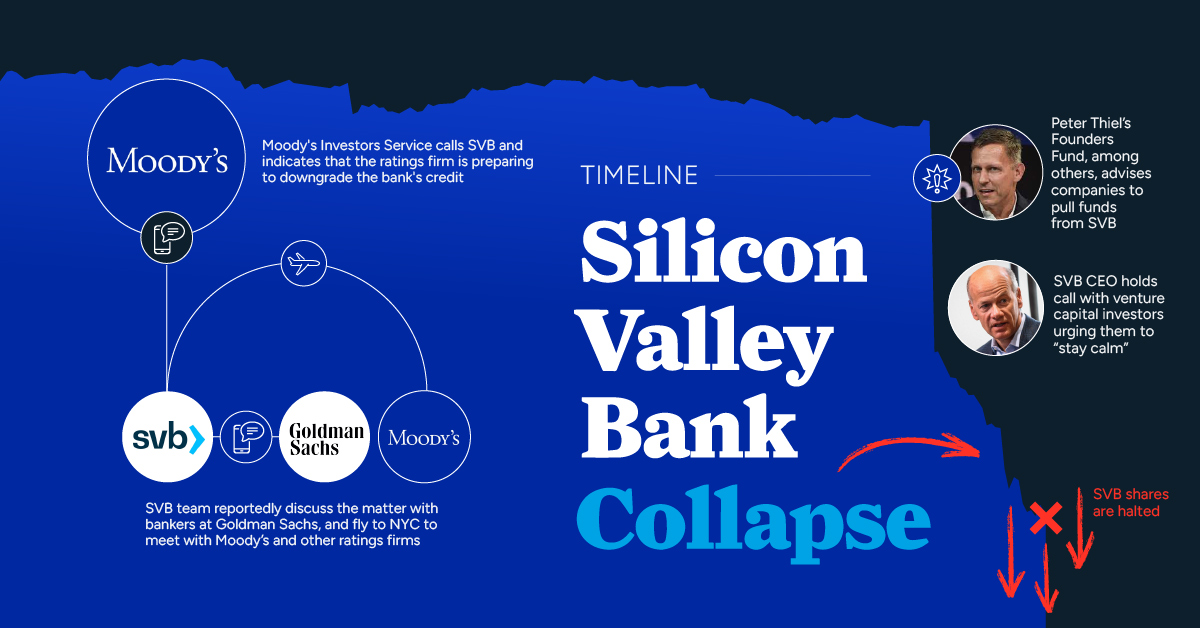

As well, the bank was viewed positively in a number of places. Most Wall Street analyst ratings were overwhelmingly positive on the bank’s stock, and Forbes had just added the bank to its Financial All-Stars list. Outward signs of trouble emerged on Wednesday, March 8th, when SVB surprised investors with news that the bank needed to raise more than $2 billion to shore up its balance sheet. The reaction from prominent venture capitalists was not positive, with Coatue Management, Union Square Ventures, and Peter Thiel’s Founders Fund moving to limit exposure to the 40-year-old bank. The influence of these firms is believed to have added fuel to the fire, and a bank run ensued. Also influencing decision making was the fact that SVB had the highest percentage of uninsured domestic deposits of all big banks. These totaled nearly $152 billion, or about 97% of all deposits. By the end of the day, customers had tried to withdraw $42 billion in deposits.

What Triggered the SVB Collapse?

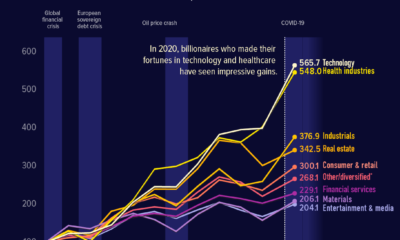

While the collapse of SVB took place over the course of 44 hours, its roots trace back to the early pandemic years. In 2021, U.S. venture capital-backed companies raised a record $330 billion—double the amount seen in 2020. At the time, interest rates were at rock-bottom levels to help buoy the economy. Matt Levine sums up the situation well: “When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off.” Source: Pitchbook Why is this important? During this time, SVB received billions of dollars from these venture-backed clients. In one year alone, their deposits increased 100%. They took these funds and invested them in longer-term bonds. As a result, this created a dangerous trap as the company expected rates would remain low. During this time, SVB invested in bonds at the top of the market. As interest rates rose higher and bond prices declined, SVB started taking major losses on their long-term bond holdings.

Losses Fueling a Liquidity Crunch

When SVB reported its fourth quarter results in early 2023, Moody’s Investor Service, a credit rating agency took notice. In early March, it said that SVB was at high risk for a downgrade due to its significant unrealized losses. In response, SVB looked to sell $2 billion of its investments at a loss to help boost liquidity for its struggling balance sheet. Soon, more hedge funds and venture investors realized SVB could be on thin ice. Depositors withdrew funds in droves, spurring a liquidity squeeze and prompting California regulators and the FDIC to step in and shut down the bank.

What Happens Now?

While much of SVB’s activity was focused on the tech sector, the bank’s shocking collapse has rattled a financial sector that is already on edge.

The four biggest U.S. banks lost a combined $52 billion the day before the SVB collapse. On Friday, other banking stocks saw double-digit drops, including Signature Bank (-23%), First Republic (-15%), and Silvergate Capital (-11%).

Source: Morningstar Direct. *Represents March 9 data, trading halted on March 10.

When the dust settles, it’s hard to predict the ripple effects that will emerge from this dramatic event. For investors, the Secretary of the Treasury Janet Yellen announced confidence in the banking system remaining resilient, noting that regulators have the proper tools in response to the issue.

But others have seen trouble brewing as far back as 2020 (or earlier) when commercial banking assets were skyrocketing and banks were buying bonds when rates were low.