In the past seven months, 42% of U.S. consumers have missed paying one or more bills, while over a third (39%) believe they will need to skip payments in the future. This visualization breaks down the state of U.S. consumers’ personal finances during the COVID-19 era, and projects into future concerns around savings.

Pandemic Personal Finances: Key Takeaways

Based on data from the doxoINSIGHTS Bills Pay Impact Report across 1,568 sampled households, three themes emerge:

57% of consumers’ incomes have taken a hit in the past seven months 70% have delayed discretionary spending on big purchases 75% continue to be very worried about their future financial health

How do these anxieties translate into day-to-day consequences?

Pandemic Postpones Bill Payments

Unsurprisingly, worrying about personal finances also means that more Americans are deferring their bill payments during the pandemic. However, these vary depending on the type of bill, total amount, and immediate urgency. Over a quarter (27%) of U.S. consumers report having missed a bill on their auto loans, followed by 26% for utilities and 25% on cable or internet costs. The average cost of the above three bill types is $258—but that’s still a fraction of the two most expensive bills, mortgage or rent, which come in at $1,268 and $1,023 respectively.

Prioritizing Payments

While 20% of Americans say they’ve missed a rent payment over the past few months, what’s even more alarming is that 28% of U.S. consumers believe they will most likely skip paying rent in the future. Another clear trend is that many Americans are prioritizing insurance payments, particularly health insurance. This is good news during a global pandemic—only 10% have missed paying this bill type, although 15% expect to skip it in the coming months. According to the report, some U.S. consumers seem to prioritize the bill types which come with strings attached, from late-payment penalties to accrued interest. While missing a single payment might seem harmless, a pattern of missed payments over time have the potential to negatively impact your credit score.

Enough Savings To Stay Afloat?

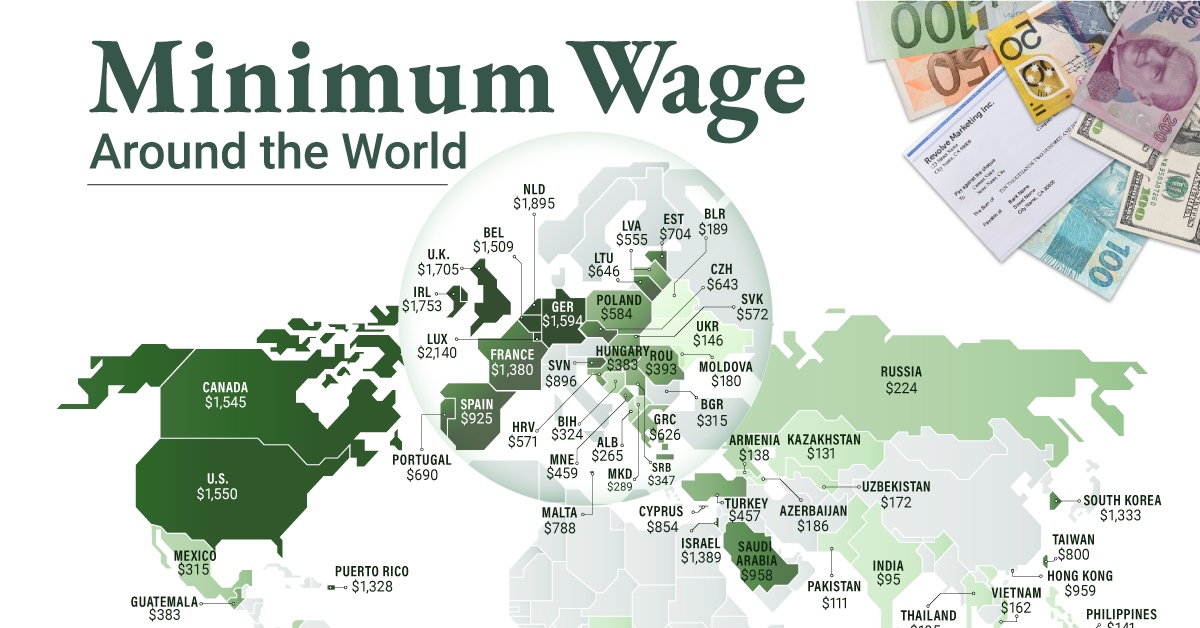

Finally, Americans are wary about how much they have stashed away in the bank to weather the tumultuous months ahead. While unemployment figures are recovering from historic troughs, the fear of losing one’s job remains prevalent. How many months’ worth of savings do U.S. consumers think they have if this were to happen? No one knows how long the COVID-19 chaos will last. In order to adapt to this economic uncertainty, consumer priorities are shifting along with their tightened budgets. on To see how the minimum wage differs around the world, we’ve visualized data from Picodi, which includes values for 67 countries as of January 2023.

Monthly Minimum Wage, by Country

The following table includes all of the data used in this infographic. Each value represents the monthly minimum wage a full-time worker would receive in each country. Picodi states that these figures are net of taxes and have been converted to USD. Generally speaking, developed countries have a higher cost of living, and thus require a higher minimum wage. Two outliers in this dataset are Argentina and Turkey, which have increased their minimum wages by 100% or more from January 2022 levels. Turkey is suffering from an ongoing currency crisis, with the lira losing over 40% of its value in 2021. Prices of basic goods have increased considerably as the Turkish lira continues to plummet. In fact, a 2022 survey found that 70% of people in Turkey were struggling to pay for food. Argentina, South America’s second-biggest economy, is also suffering from very high inflation. In response, the country announced three minimum wage increases throughout 2022.

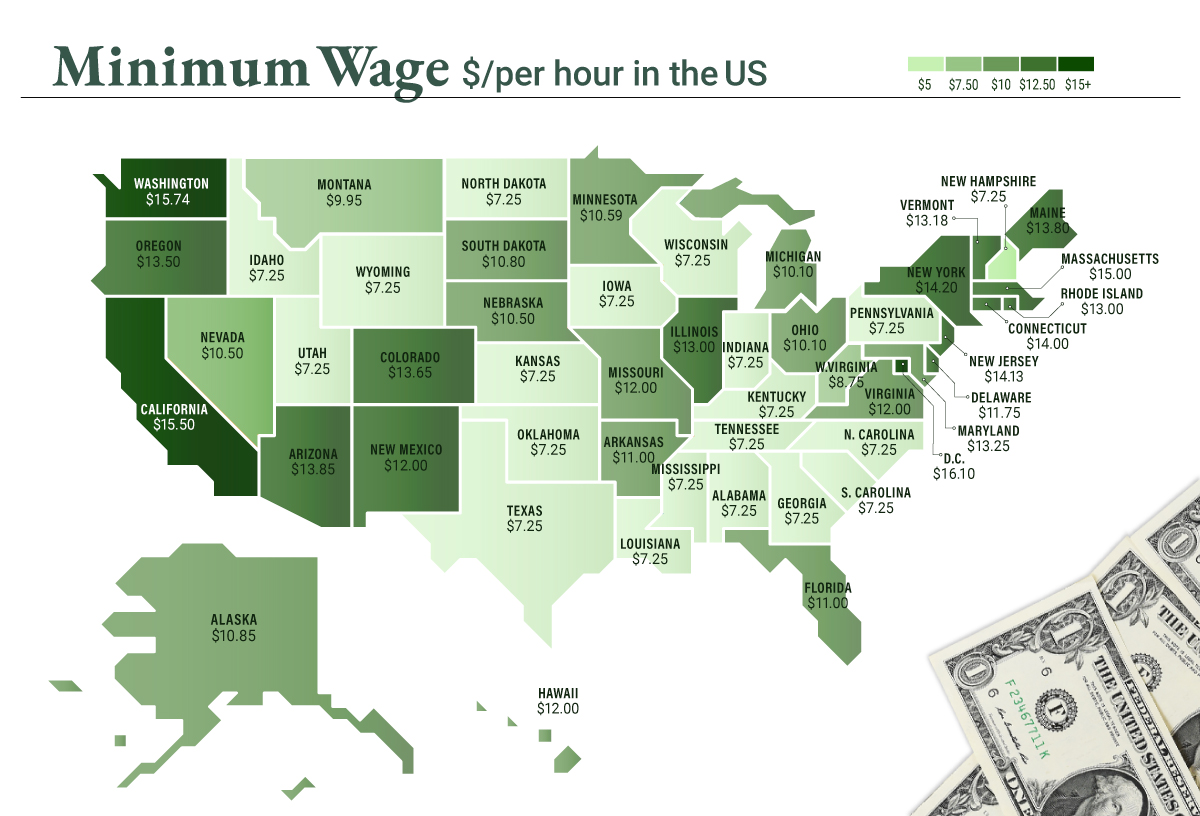

Minimum Wage in the U.S.

Within the U.S., minimum wage varies significantly by state. We’ve visualized each state’s basic minimum rate (hourly) using January 2023 data from the U.S. Department of Labor.

2023-03-17 Update: This map was updated to fix several incorrect values. We apologize for any confusion this may have caused. America’s federal minimum wage has remained unchanged since 2009 at $7.25 per hour. Each state is allowed to set their own minimum wage, as long as it’s higher than the federal minimum. In states that do not set their own minimum, the federal minimum applies. If we assume someone works 40 hours a week, the federal minimum wage of $7.25 translates to an annual figure of just $15,080 before taxes. California’s minimum wage of $15.50 translates to $32,240 before taxes. For further perspective, check out our 2022 infographic on the salary needed to buy a home across 50 U.S. cities.